Introduction

10 Smart Investment Strategies to Grow Your Wealth: In today’s fast-paced financial world, knowing where and how to invest your money is more crucial than ever. Building wealth goes beyond saving – it’s about making strategic decisions that allow your money to grow over time.

Whether you’re new to investing or looking to enhance your existing portfolio, understanding effective strategies can make all the difference.

Here, we’ll explore 10 smart investment strategies that can help you grow your wealth sustainably. From stocks and real estate to alternative assets and retirement planning, each strategy has unique benefits and risks. Let’s dive into actionable tips and insights to empower your investment journey.

1. Start with a Solid Financial Foundation

Top 10 Proven Ways to Make Money Online in 2024

Before diving into investments, it’s essential to ensure that you have a stable financial base. Building wealth on a shaky foundation can lead to setbacks and unnecessary risks. Here are some critical steps:

- Emergency Fund: Have at least three to six months’ worth of living expenses saved in a liquid, accessible account. This cushion prevents you from liquidating investments during financial emergencies.

- Manage Debt: High-interest debt, like credit card debt, can eat into your returns. Pay down debt before making substantial investments.

- Budget Wisely: A budget ensures you have enough cash flow for investments and daily expenses without overextending your finances.

2. Set Clear Investment Goals

Small Business Health Insurance Plans Texas

Defining your investment objectives helps in choosing the right strategies. Consider these primary investment goals:

- Retirement: Investing for a secure retirement involves long-term strategies with tax-advantaged accounts, like 401(k)s or IRAs.

- Education: A 529 plan or other education-focused accounts can help save for future tuition costs.

- Wealth Accumulation: If your goal is to amass wealth, you might focus on growth stocks or other high-return opportunities.

- Income Generation: Dividend stocks, rental properties, or bonds can help provide a steady income stream.

Establishing these goals with specific time horizons allows you to select appropriate investments and gauge your risk tolerance.

3. Diversify Your Portfolio

Top 10 Insurance Plans in the USA

“Don’t put all your eggs in one basket” is timeless investment wisdom. Diversification helps spread risk across various asset classes. Here are ways to diversify effectively:

- Asset Allocation: Divide your investments among stocks, bonds, real estate, and cash equivalents. The percentage allocated to each should depend on your age, risk tolerance, and financial goals.

- International Exposure: Investing in international markets broadens your exposure to growth opportunities outside your home country.

- Sector-Based Diversification: Within each asset class, diversify by investing in various industries (e.g., technology, healthcare, finance) to reduce sector-specific risks.

Diversifying doesn’t eliminate risk, but it can reduce the impact of underperformance in any one asset or sector.

4. Invest in Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) are popular investment choices for their simplicity, low fees, and broad market exposure.

- Index Funds: These funds track a specific index, like the S&P 500, and offer a way to invest in the overall market.

- ETFs: ETFs offer flexibility because they trade like stocks and often have lower expense ratios than mutual funds. ETFs can focus on sectors, commodities, or regions, allowing for targeted diversification.

By regularly investing in index funds and ETFs, you can benefit from compounding returns while minimizing individual stock risk.

5. Take Advantage of Tax-Advantaged Accounts

Tax-efficient investing allows more of your money to grow over time. Here are some common tax-advantaged accounts to consider:

- 401(k) or 403(b): Employer-sponsored retirement accounts with tax-deferred growth. Many employers match contributions, offering an immediate return.

- IRA (Individual Retirement Account): Both Traditional and Roth IRAs offer tax advantages for retirement savings. Traditional IRAs provide tax-deferred growth, while Roth IRAs grow tax-free.

- Health Savings Account (HSA): If you have a high-deductible health plan, an HSA offers triple tax advantages – tax-free contributions, tax-free growth, and tax-free withdrawals for medical expenses.

Utilizing these accounts can help reduce taxable income, leaving more capital for investment growth.

6. Invest in Dividend Stocks for Passive Income

Dividend stocks offer a reliable income stream, especially when markets are volatile. Many companies distribute a portion of their earnings to shareholders through dividends.

- Dividend Yield: Look for companies with a solid dividend yield and a history of steady or growing dividend payouts.

- Reinvestment: Consider reinvesting dividends to maximize compounding returns over time. Many brokerage accounts offer automatic dividend reinvestment plans.

- Dividend Aristocrats: Some companies, known as Dividend Aristocrats, have increased dividends annually for 25+ years. These are often considered safe and stable investments.

A portfolio of dividend stocks can provide both income and capital appreciation over the long term.

7. Consider Real Estate Investments

Real estate can be a valuable part of an investment portfolio, offering tangible assets and the potential for substantial returns.

- Rental Properties: Buying properties to rent can provide a steady income stream, with potential appreciation in property value over time.

- REITs (Real Estate Investment Trusts): For those not interested in directly managing property, REITs offer exposure to real estate. They pay high dividends and allow diversification across various property types.

- House Hacking: Buying a multi-unit property, living in one unit, and renting the others is an effective strategy for those just starting in real estate.

Real estate investments are generally more stable than stocks, though they may require more capital and come with specific risks like property maintenance costs.

8. Explore Alternative Investments

Alternative investments, such as commodities, private equity, and hedge funds, can further diversify a portfolio. While these are typically riskier and less liquid, they can provide high returns and low correlation with traditional assets.

- Commodities: Investing in gold, silver, or oil offers a hedge against inflation and market downturns.

- Private Equity and Venture Capital: These investments allow exposure to early-stage companies with high growth potential.

- Cryptocurrencies: Although volatile, digital assets like Bitcoin and Ethereum have gained popularity as alternative investments. Proceed cautiously and allocate only a small percentage of your portfolio.

Alternative investments can enhance portfolio diversification but should be used thoughtfully, especially for beginner investors.

9. Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy where you invest a fixed amount regularly, regardless of the market price. This approach has several benefits:

- Reduced Impact of Volatility: DCA mitigates the effects of market fluctuations, as you buy more shares when prices are low and fewer when prices are high.

- Discipline: DCA encourages consistent investing habits, making it easier to avoid the temptation of timing the market.

- Ease of Implementation: Setting up automatic contributions to investment accounts simplifies this strategy, allowing you to “set it and forget it.”

Dollar-cost averaging is particularly effective with mutual funds and ETFs, especially for long-term goals like retirement.

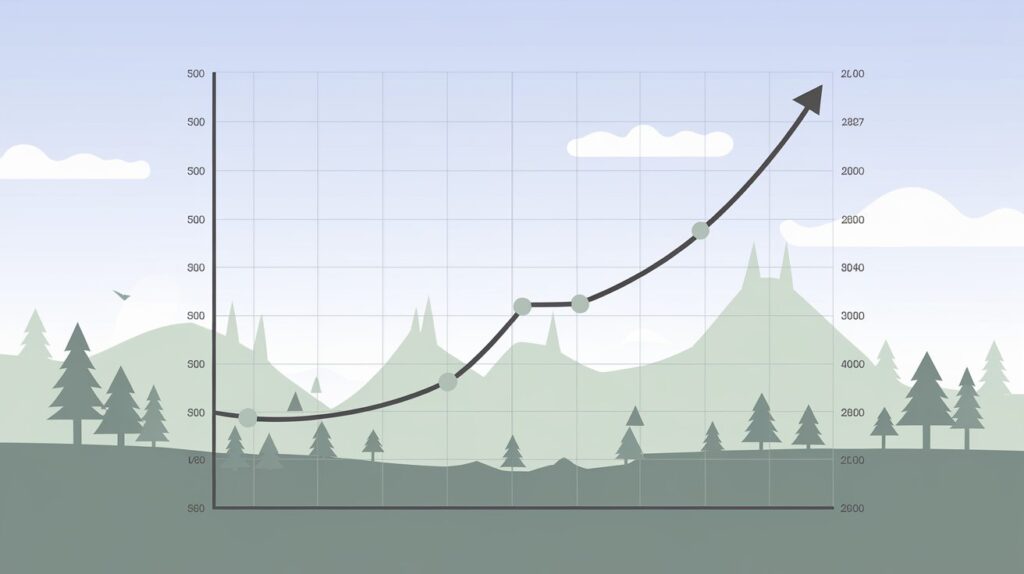

10. Prioritize Long-Term Growth over Short-Term Gains

Building wealth takes patience and resilience. Focusing on long-term strategies rather than short-term gains helps reduce the emotional aspect of investing and capitalizes on the power of compounding.

- Compounding Growth: Reinvesting gains can exponentially grow your portfolio over time. The longer you hold investments, the more compounding works in your favor.

- Avoid Emotional Reactions: Markets fluctuate, and reacting to every dip can hinder your portfolio’s growth. Stay the course and focus on the bigger picture.

- Regular Portfolio Review: Periodically assess your investments and adjust allocations as needed based on your goals and risk tolerance.

A long-term perspective minimizes the impact of market noise and increases the likelihood of achieving financial independence.

Frequently Asked Questions

1. What is the best investment strategy for beginners?

For beginners, starting with a diversified portfolio of low-cost index funds and ETFs is generally a safe, effective way to enter the market. These funds offer exposure to various sectors and minimize risk while building wealth.

2. How much should I invest initially?

The amount you invest initially depends on your financial situation, goals, and risk tolerance. Starting small and gradually increasing contributions as you gain confidence and resources is a practical approach.

3. How often should I review my investment portfolio?

Reviewing your portfolio once or twice a year is usually sufficient. However, major life changes or shifts in financial goals may warrant more frequent reviews to ensure your portfolio remains aligned with your objectives.

4. Are real estate investments risky?

Real estate investments can be risky, especially for beginners. However, with proper research and a long-term perspective, they can provide stable income and appreciation over time.

5. What’s the difference between active and passive investing?

Active investing involves frequent buying and selling of securities to outperform the market. Passive investing, on the other hand, focuses on long-term growth by mirroring market indices, typically with lower fees and a more hands-off approach.

Final Thoughts: Building Wealth with Confidence

Growing your wealth is a journey that requires patience, knowledge, and consistent effort. By employing these investment strategies thoughtfully, you can create a stable, diversified portfolio that works toward your long-term financial goals. Remember, every investment carries some level of risk, so stay informed, review your portfolio regularly, and seek professional advice when needed. With discipline and a solid strategy, financial independence can be within reach.

2 thoughts on “10 Smart Investment Strategies to Grow Your Wealth”