Medicare is a crucial program that helps millions of Americans access healthcare. However, it doesn’t cover everything, leading many to consider Medicare Supplement plans.

One popular option is Humana Insurance’s Medicare Supplement. This article will provide an in-depth look at Humana’s offerings, helping you make informed decisions about your healthcare coverage.

Understanding Medicare Supplements

Workers Compensation Insurance Construction

What Are Medicare Supplements?

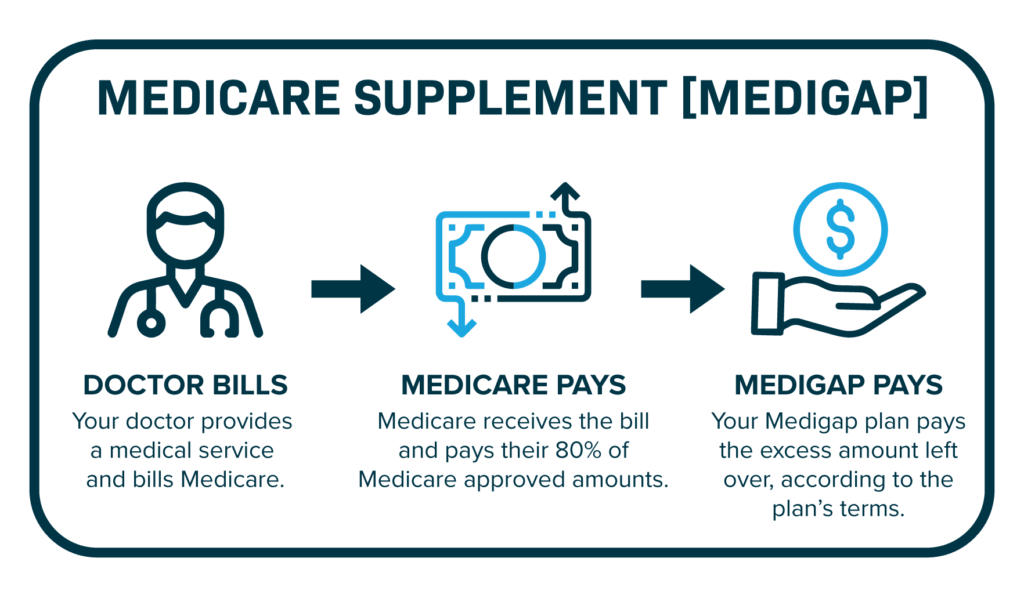

Medicare Supplements, also known as Medigap plans, are designed to cover the gaps in Original Medicare (Part A and Part B).

These plans help pay for out-of-pocket costs such as copayments, coinsurance, and deductibles. Essentially, they offer additional financial protection for healthcare expenses.

Why Consider a Medicare Supplement?

While Original Medicare provides essential coverage, it leaves many costs unpaid. A Medicare Supplement can help you manage these expenses better, ensuring you have access to necessary medical services without breaking the bank.

Humana Insurance Overview

Who Is Humana?

Humana is one of the largest health insurance providers in the United States. Founded in 1961,

the company has established a solid reputation for offering various healthcare plans, including Medicare Advantage, Medicare Part D, and Medicare Supplement plans.

Why Choose Humana for Medicare Supplements?

Humana stands out for several reasons:

- Wide Range of Plans: Humana offers multiple Medigap plans, allowing you to select coverage that fits your specific needs.

- Customer Service: The company is known for its responsive customer support, which can help you navigate your healthcare options.

- Additional Benefits: Some Humana Medicare Supplement plans come with extra perks like wellness programs and discounts on health-related products.

Humana Medicare Supplement Plans

Top 10 Insurance Plans in the USA

Types of Plans Offered

Humana provides a variety of Medicare Supplement plans, each designed to cater to different healthcare needs. The most common plans include:

- Plan A: Covers basic benefits, including hospital and outpatient services.

- Plan B: Offers additional coverage for the Medicare Part A deductible.

- Plan C: Includes all Plan A benefits, plus coverage for skilled nursing facility care.

- Plan F: Known for comprehensive coverage, including out-of-pocket costs for Medicare Part A and B.

- Plan G: Similar to Plan F but excludes the Part B deductible.

- Plan N: Offers lower premiums with cost-sharing features.

Comparing Plans

When considering a Humana Medicare Supplement plan, it’s essential to compare the benefits of each option.

For instance, if you frequently visit specialists, a plan with lower coinsurance may be beneficial.

Alternatively, if you prefer lower monthly premiums, consider a plan with higher out-of-pocket costs.

Eligibility and Enrollment

Who Is Eligible?

To qualify for a Humana Medicare Supplement plan, you must be enrolled in Medicare Part A and Part B.

Typically, the best time to enroll is during your Medigap Open Enrollment Period, which lasts six months after you turn 65 and enroll in Medicare.

How to Enroll

Enrolling in a Humana Medicare Supplement plan is straightforward:

- Visit the Humana Website: Start by browsing their Medigap offerings online.

- Contact a Representative: For personalized assistance, reach out to a Humana representative.

- Complete the Application: Fill out the necessary application forms and provide any required documentation.

Cost of Humana Medicare Supplement Plans

Small Business Health Insurance Plans Texas

Premiums and Costs

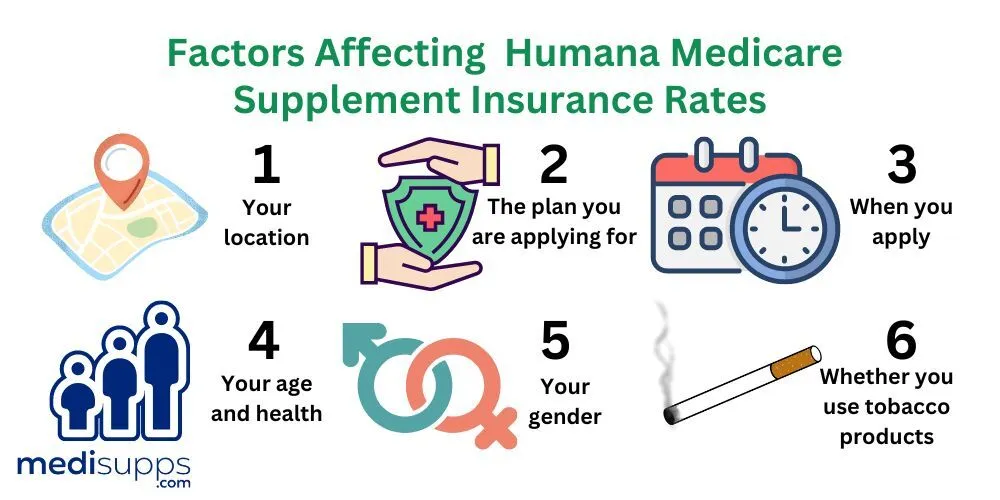

The cost of Humana Medicare Supplement plans varies based on several factors, including:

- Location: Premiums can differ significantly depending on where you live.

- Plan Type: More comprehensive plans typically come with higher premiums.

- Age and Health: Your age and health status may also affect your premium rates.

How to Save on Costs

- Shop Around: Compare different plans and prices from various insurers to find the best deal.

- Consider Your Healthcare Needs: Choose a plan that matches your healthcare needs to avoid paying for unnecessary coverage.

- Utilize Discounts: Check if Humana offers any discounts for enrolling in multiple plans or for good health.

Benefits of Choosing Humana Insurance

Comprehensive Coverage

Humana Medicare Supplement plans provide extensive coverage for various medical expenses, ensuring you have the necessary financial support for healthcare.

Flexibility and Choice

Humana offers a range of plans, allowing you to select coverage that aligns with your unique healthcare requirements.

Support and Resources

Humana provides valuable resources, including wellness programs and educational materials, to help you manage your health effectively.

Personal Experiences and Testimonials

Real-Life Examples

Many Humana Medicare Supplement members have shared positive experiences regarding their coverage.

For instance, one member noted that having a Humana plan allowed her to receive critical treatments without worrying about high out-of-pocket costs.

Customer Satisfaction Ratings

Humana consistently receives high ratings for customer service and satisfaction. Positive feedback highlights their user-friendly online tools and helpful customer support.

Tips for Selecting the Right Plan

Assess Your Healthcare Needs

Before choosing a Humana Medicare Supplement plan, evaluate your healthcare needs. Consider how often you visit doctors, any ongoing treatments, and your budget for premiums.

Understand the Terms

Familiarize yourself with the terms and conditions of each plan. This knowledge will help you make an informed decision and avoid surprises later.

Seek Professional Guidance

If you’re unsure which plan to choose, consider consulting with a licensed insurance agent. They can provide insights and help you navigate the options available.

Making the Most of Your Medicare Supplement Plan

Utilize Preventive Services

Many Medicare Supplement plans cover preventive services at no additional cost. Take advantage of these services to maintain your health and catch potential issues early.

Stay Informed

Stay updated on any changes to your plan, including new benefits or coverage options. Regularly reviewing your policy ensures you’re making the most of your coverage.

Reach Out for Support

If you have questions or concerns about your plan, don’t hesitate to contact Humana’s customer service. They can assist you with any issues and provide valuable resources.

Your Path to Better Healthcare Coverage

Navigating the world of Medicare Supplements can be daunting, but with the right information, you can make informed choices that enhance your healthcare experience.

Humana Insurance offers a range of Medicare Supplement plans tailored to meet your needs, providing peace of mind as you navigate your health journey.

Frequently Asked Questions (FAQ)

1. What is the difference between Original Medicare and Medicare Supplement plans?

Original Medicare covers hospital and outpatient services, while Medicare Supplement plans fill the gaps in that coverage, helping with out-of-pocket costs.

2. Can I change my Medicare Supplement plan at any time?

Yes, you can change your plan at any time, but you may have to go through medical underwriting unless you’re within the Open Enrollment Period.

3. How do I file a claim with Humana?

Most claims are submitted automatically by your healthcare provider. However, if you need to file a claim, you can do so through Humana’s website or by contacting their customer service.

4. Are prescription drugs covered under Humana Medicare Supplement plans?

No, Medicare Supplement plans do not cover prescription drugs. You would need to enroll in a separate Medicare Part D plan for that coverage.

5. How can I contact Humana for more information?

You can contact Humana through their website, customer service hotline, or by visiting a local Humana office.

1 thought on “Humana Insurance Medicare Supplement”